Brand Symbiosis in Financial Services:

Why Banks Must Connect the Brand Dots

3 October 2025

When you open Spotify, Nike, or Netflix, you don’t just complete a task. You feel the brand. Spotify adapts to your mood and context. Nike motivates you, turning a shopping journey into inspiration. Netflix doesn’t just recommend, it entertains in a way that feels personal. These brands deliver more than utility. They deliver a human brand: nurturing, responsive, living and breathing in every interaction.

These brands don’t just express themselves through experience. The experience itself feeds the brand. It’s a loop: the brand sets the tone, the experience delivers it, and each interaction makes the brand smarter and more relevant. That reciprocity is what makes them feel alive.

Financial services, by contrast, still lags behind. Banking apps are slick, secure, and functional. Campaigns are polished and emotive. But rarely do the two connect. The result? Banks deliver the transaction but miss the chance to reinforce what their brand means. And this is extraordinary when you consider how often people interact with their bank: in the 2025 Financial Habits Survey, 36% of respondents said they check their balance daily, and another 33% a few times per week (MarketWatch). That frequency presents a vast opportunity for financial brands to show up, reassure, and connect, yet so many of those moments remain brand-quiet.

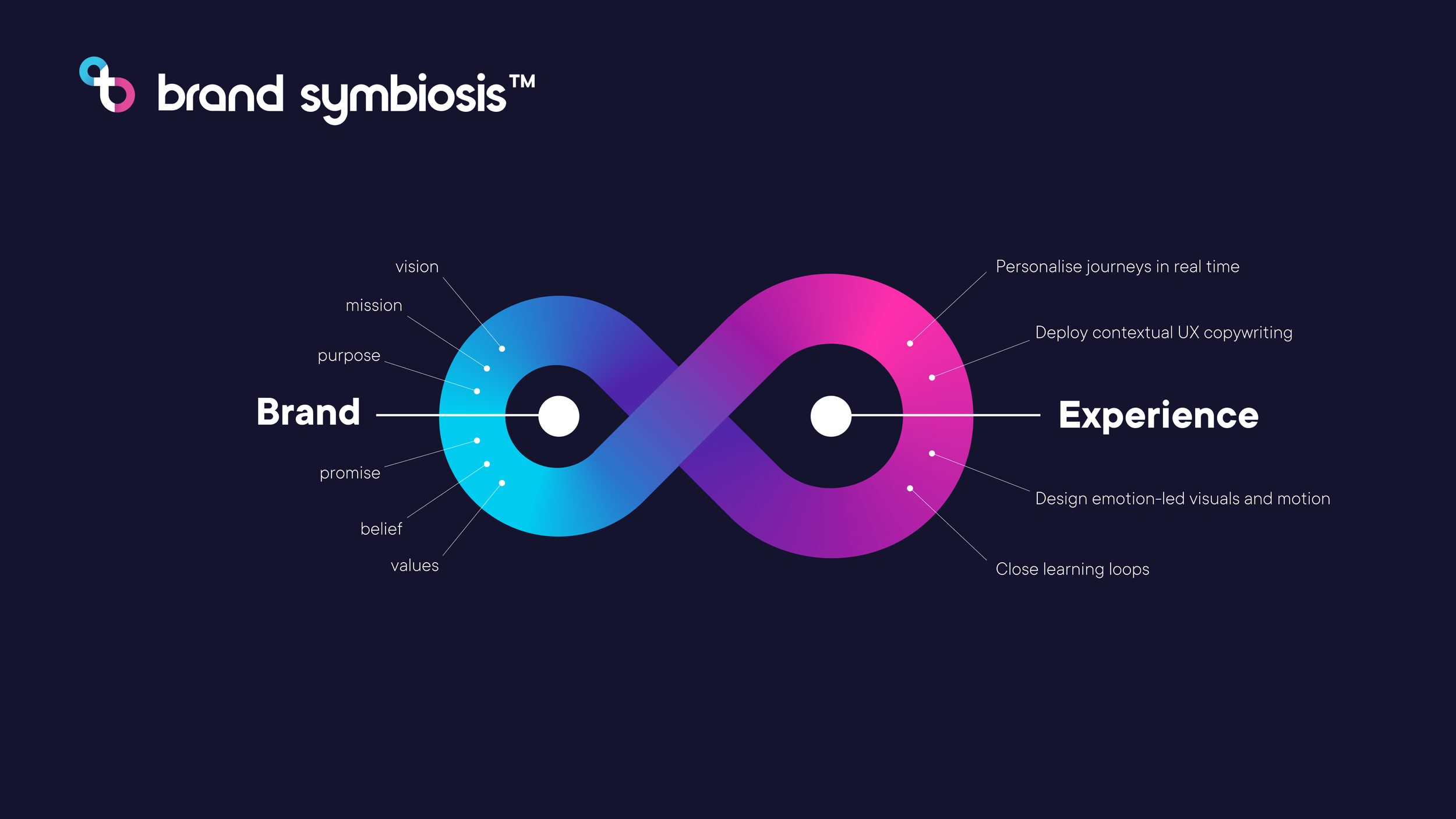

We call the solution T8’s Brand Symbiosis™. Brand Symbiosis is not just about brand and experience living side by side. It’s about them learning from one another. The brand shapes the experience, and the experience in turn refines the brand. The more the loop turns, the more relevant, responsive, and resonant the brand becomes.

Why FS needs it most

Trust is the foundation of financial services. But trust today requires more than security; it requires empathy and responsiveness. Banks cannot afford to treat brand as a campaign and experience as a product. In a world of daily interactions, the brand must be present in every tap, every confirmation, every reassurance.

What Brand Symbiosis™ looks like

The essence of the brand (vision, mission, purpose, promise, belief, values) remains steady. But its expression flexes with context:

Onboarding? Confident and clear: words and visuals that inspire momentum.

Fraud resolution? Calm and empathetic: language and design that ease anxiety.

Reaching a savings milestone? Energetic and celebratory: copy, visuals, and motion that create delight.

It’s not just about words. It’s about visual stimulation, emotional cues, and adaptive design working together to deliver the brand in every moment.

Who is leading, and why FS lags

Historically, branches were treated as brand showcases – architecture, service, and staff behaviours all designed to leave an impression. Yet digital has been treated differently: inside banks, apps are too often defined by executives and product owners as task-focused utilities, built on the belief that people are there only for efficiency. That belief perpetuates the problem: when you design only for tasks, you strip away opportunities for deeper engagement, exploration, and brand connection. The irony? Apps now carry far more customer interactions than branches ever did.

And because most banks still see them as purely functional, experiences converge, complaints about sameness grow, and the cycle of chasing the next star feature begins. This is the trap of incrementalism: banks compete on the next shiny feature to differentiate, but those features are quickly copied and commoditised. The bigger opportunity – building distinction through brand-led experience – remains overlooked.

Some FS brands are edging forward. Monzo’s playful language creates a sense of humanity. DBS in Singapore integrates banking into lifestyle services. But these are still largely functional advances and incremental steps, not transformative ones. By contrast, outside FS, leaders like Nike and Spotify have turned every interaction into an embodiment of brand identity. Customers won’t remember which bank launched the latest feature first. They’ll remember how they felt – the human factor that builds trust, connection, and differentiation.

Making it a reality

At T8, we are developing T8’s Brand Symbiosis™ Framework in collaboration with pioneering AI and data specialists, to show how banks can:

Personalise journeys in real time using AI, adjusting flow, tone, and visuals.

Deploy contextual UX copywriting that flexes from empathetic to celebratory.

Design emotion-led visuals and motion that reassure, calm, or inspire.

Close learning loops that capture signals (hesitation, frustration, satisfaction) and feed them back into both the experience and the brand expression.

The way forward

Banks are woven into our daily lives. Every time we check a balance, transfer money, or set aside savings, the brand should be there. That is what it means for a financial brand to truly live: a brand that leads the experience, learns from the experience, and improves with every interaction.

Need help? Reach out to us.